Collaborative Research

Vendor Analysis: Aravo - Third-Party Risk Management Solutions, 2021

A detailed look at Aravo’s 3PRM quadrant positioning and scoring, and Chartis’ underlying opinion and analysis.

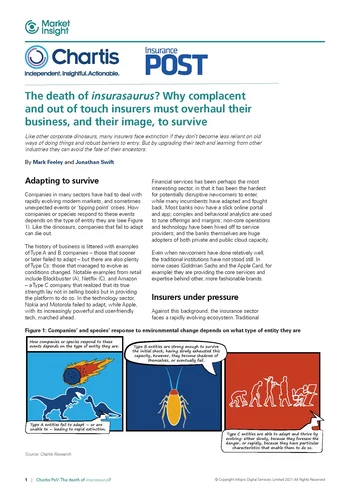

The death of insurasaurus? Why complacent and out of touch insurers must overhaul their business, and their image, to survive

Like other corporate dinosaurs, many insurers face extinction if they don’t become less reliant on old ways of doing things and robust barriers to entry. But by upgrading their tech and learning from other industries they can avoid the fate of their…

Stress Testing and Climate Change

This report from Chartis and Moody’s ESG Solutions Group considers how climate stress tests are developed, and assesses the data, technology and modeling requirements and challenges involved.

Beyond IFRS 17/LDTI: the Journey to System Modernization

This report, a collaboration between Chartis and FIS, examines the impact of IFRS 17 and LDTI on the insurance industry, giving an overview of the changes observed in the market, the industry’s evolving response, and how firms should prepare for the…

Effective Onboarding in Wholesale Banks: Examining challenges and defining best practices

This collaborative report from Chartis and iMeta discusses the risk and technology perspectives of client onboarding in wholesale banking, setting out the challenges and best practices for financial institutions.

The Heart of IFRS 17 Compliance

This report examines the trends and dynamics around IFRS 17 compliance, examining why long-term success for insurance firms requires a heterogeneous, flexible and scalable data-management framework.

Investment Portfolio Excellence: The Conviction of One Truth

This collaborative report assesses how investment managers can gain an accurate, comprehensive view of their portfolios to enhance their competitiveness.

Chartis Research – Research Agenda: Q3/4 2020 Update

This short report is the second of our quarterly updates in which we review our research agenda and extend it by one quarter.

Vendor Analysis: Oracle Financial Services - Insurance Risk Systems for IFRS 17 and LDTI Compliance, 2020

This Vendor Analysis is based on the Chartis quadrant report 'Insurance Risk Systems for IFRS 17 and LDTI Compliance, 2020: Market Update and Vendor Landscape' (published in June 2020). This section summarizes the key theses in that report; subsequent…

Vendor Analysis: Moody’s Analytics - CLO Solutions, 2020

This Vendor Analysis is based on the Chartis quadrant report ‘Technology Solutions for Credit Risk 2.0: Credit Risk Analytics, 2020; Market Update and CVA/CLO Solutions Vendor Landscape’ (published in April 2020). This section summarizes the key theses…

Achieving Effective IFRS 17 Reporting

In this report, created in collaboration with Workiva, we focus on the challenges associated with IFRS 17 reporting, and consider solutions to those challenges from the perspectives of accounting policy and technology implementation. And in highlighting…

Calculating Return on Investment for Client Lifecycle Management Using the Fenergo Solution

Chartis Research and Fenergo have developed a focused return on investment (ROI) model for CLM, to determine how much value financial institutions (FIs) can hope to achieve from their CLM solutions. This report outlines the Chartis model, its methodology…

RiskTech100 2020 Winners' Review

This supplement to the main RiskTech100 ranking report highlights the achievements and innovations of many of the featured vendors, giving readers a glimpse into what makes them successful.

More Than Just Policy: Effective Model Risk Management in a New Age

This report – a collaborative publication from Chartis and ClusterSeven – examines a crucial period of activity for MRM users and sellers. It considers what MRM now means in a post-IFRS 9/CECL world, and how FIs can develop effective MRM solutions in…

Vendor Analysis: GBG: AML and Watchlist Monitoring Systems, 2019

This Vendor Analysis is based on the Chartis quadrant report Financial Crime Risk Management Systems: AML and Watchlist Monitoring; Market Update and Vendor Landscape, 2019 (published in March 2019).

The State of AI in Risk Management

Spotlighting collaborative research between Chartis and our research partner Tata Consultancy Services (TCS), the report analyses the adoption of AI tools by risk departments across financial services.

Beyond Detection: Driving Automation and Artificial Intelligence into Financial Crime Risk Management

This report examines AI and automation within the context of an FIU. It explores how these technologies can help in AML and trade surveillance, and offers practical advice on overcoming organizational and regulatory obstacles to their deployment.