ALM comes of age: meeting the challenges as a new standard emerges

Asset and liability management (ALM) is a core function of the financial institution (FI), and a mainstay of any successful business operation. Over time the ALM technology landscape, a broad area beset by ambiguous definitions and terminology, has enjoyed increased specification and a wider understanding of how it operates. And as ALM matures, its processes and systems are evolving, and a new standard is emerging – a new, more complex ALM framework.

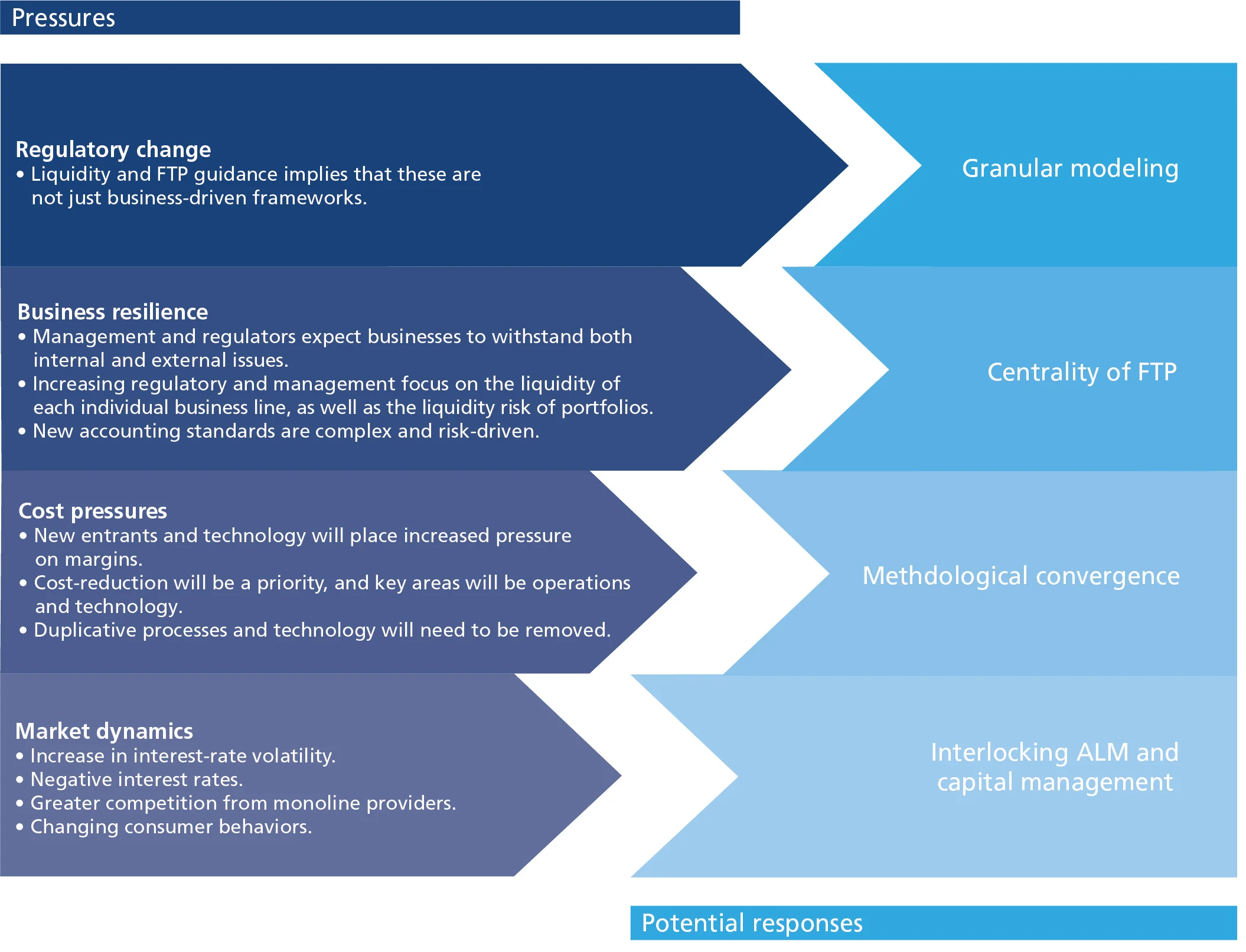

Several pressures and dynamics in the financial industry are driving this evolution and development (see Figure 1). These include market and business dynamics such as interest rate volatility, business resilience, cost pressures and, crucially, regulation. FIs are being confronted with diverse regulatory challenges and sometimes competing standards and rules, pushing them to integrate their ALM operations and unify their ALM policies under a comprehensive internal strategy.

Figure 1: Shifting dynamics are shaping the ALM landscape

Source: Chartis Research

A more holistic approach – integration is key…

At its heart ALM is a holistic process, made up of common core components that include behavioral modeling, funds transfer pricing (FTP), cash-flow projections, stress testing and reverse stress testing, scenario management, data management, and capital and balance sheet optimization. To ensure ALM functions holistically, integrating regulatory requirements and internal risk management is vital. And because ALM crosses and covers multiple departments and business lines, without effective integration the overall ALM process can be ineffective.

But integrating the multiplicity of departments, roles and responsibilities involved in ALM is not a simple task. This integration also coincides with the cross-pollination of methodologies and practices between firms across the banking book, the trading book and the insurance sector, which is further complicating the situation.

…as are differentiation, and analytical rigor

Crucially, though, the evolution of ALM is a story of integration and differentiation running in parallel. First and foremost, ALM is an analytical activity and, increasingly, a quantitative process – to manage its risks and processes, institutions require increasingly sophisticated analytical tools. From an analytical perspective it is vital that the different segments of ALM remain distinct where necessary and appropriate. To improve the focus and robustness of the analytics being developed, they must exist within the boundaries of their respective segments. The tools and practices that FIs use in distinct segments of their ALM systems should be differentiated so firms can develop methodological clarity and focused analytical rigor across their systems.

COVID-19 concerns – predicting customer behavior

And then, of course, there’s COVID-19. The profound impacts of the pandemic on the global financial system have fueled market uncertainty and raised questions about how FIs manage their ALM, which straddles multiple risk types and investment strategies. The pandemic has had several varied effects on the ALM landscape and, now more than ever, understanding and predicting customer behavior is a vital part of ALM. Stress testing and reverse stress testing, meanwhile, as well as joint credit and interest-rate risk analysis, will also come into sharper focus as institutions adapt to the crisis and prepare their future defenses.

To learn the lessons of the crisis effectively, institutions must carefully assess its current impact on their balance sheets, and the impact it will continue to have. The initial direct consequence of the pandemic is to create challenges around cash flow and the risk level of loans, and a significant proportion of loans will have to be categorized as non-performing. Longer-term issues are likely to include persistent low interest rates, adaptations to investment strategies, and the migration of credit. To prepare properly, FIs will have to rely on forecasts that are based on their scenario generation and stress tests. Customer behavior during and in the aftermath of the pandemic will also be a key component in preparing an ALM strategy in the face of COVID-19.

Much to do

There is plenty for FIs – and their technology vendors – to consider as they come to terms with the evolving ALM framework. To meet their challenges as the quantitative revolution progresses, end users and vendors should aim for clear goals in their technology development, based around a few core themes that signify an increased level of ALM sophistication. Chartis believes that these include the integration of multiple risk types, granular analysis and data aggregation, and a methodologically clear and standardized overarching framework.

Further reading

For more analysis of ALM trends and developments, and how they affect technology users and vendors, see the Chartis Research report ‘ALM Technology Systems, 2021: Market and Vendor Landscape’

(Chartis, 2021)

‘Chartis Risk Bulletin: The Technology Impacts of COVID-19’

(Chartis, 2020)

Points of View are short articles in which members of the Chartis team express their opinions on relevant topics in the risk technology marketplace. Chartis is a trading name of Infopro Digital Services Limited, whose branded publications consist of the opinions of its research analysts and should not be construed as advice.

If you have any comments or queries on Chartis Points of View, you can email the individual author, or email Chartis at info@chartis-research.com.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@chartis-research.com to find out more.

You are currently unable to copy this content. Please contact info@chartis-research.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@chartis-research.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@chartis-research.com