Measuring and managing climate risk: patchy data is undermining accuracy

To accurately price the physical risks of climate change, investors need consistent, comparable and comprehensive climate disclosures – but data is patchy. To improve physical risk management and disclosure, banks must engage more with climate-risk modelers and data providers.

Encouraging disclosure

Increasingly, investors must assess the climate-related risks faced by the companies they invest in. Consistent, comparable and relevant metrics are vital if they want to make informed decisions about corporate engagement, stock selection and investment products. In general, comprehensive disclosures ensure that the market has the right information to price climate-related risks and build climate resilience.

In 2016, the Task Force on Climate-Related Financial Disclosures (TCFD) was established to:

- Address historical shortcomings in the reporting of climate-related risks.

- Encourage corporations to calculate their exposure to climate risk and disclose it to investors and stakeholders.

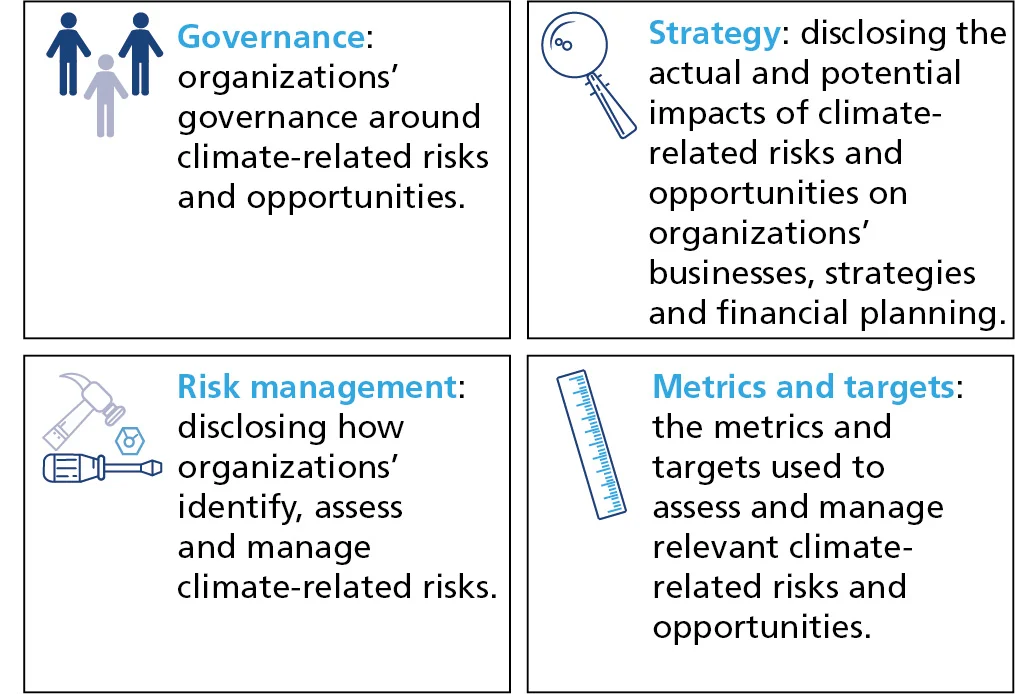

This voluntary framework covers four categories: governance, strategy, risk management, and metrics and targets (see Figure 1).

Figure 1: The Task Force on Climate-Related Financial Disclosures covers four categories

Source: Chartis Research (based on TCFD documentation)

Since the TCFD’s final recommendations report in 2017, support for the initiative has grown to over 1,440 organizations. While the TCFD’s recommendations are gradually improving firms’ integration of climate-change risks into their disclosures, progress has been uneven across sectors, geographies and the disclosure areas outlined in Figure 1. In 2019, of the 76 banks that endorsed the TCFD framework, only 39 had started to disclose, and 28 of the world’s largest banks had yet to sign up at all.

Room for improvement

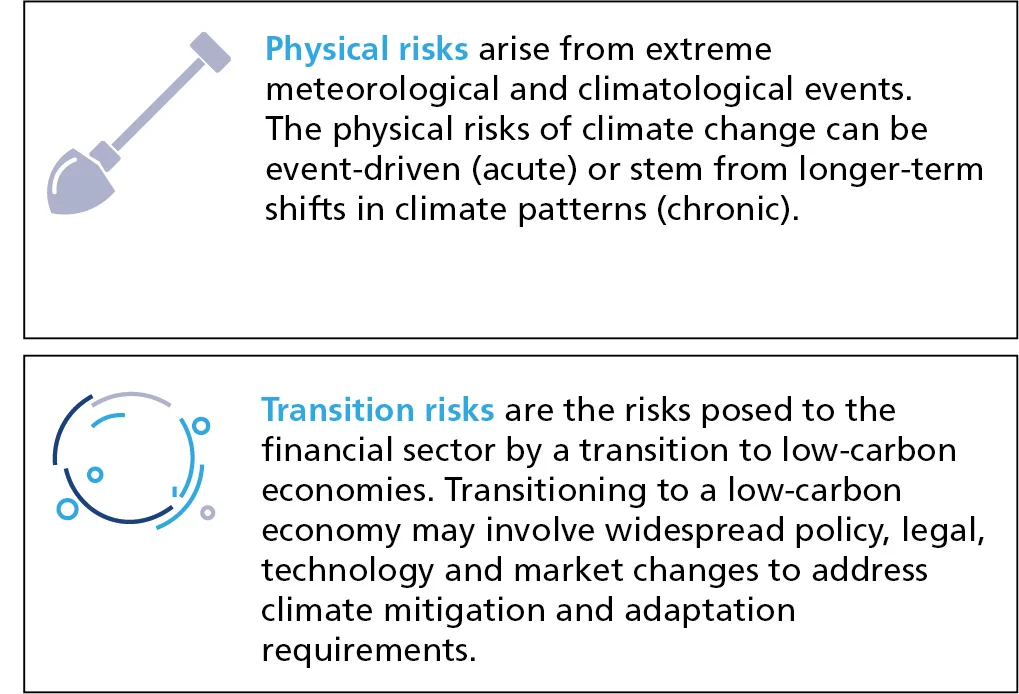

Across the financial industry, strategy disclosures are the least developed of the recommendations in the four TCFD categories. Many banks have not disclosed the results of their scenario analyses, including financial impacts or statements about the resilience of their strategies. And most banks that have carried out scenario analyses have focused more on transition risks than on physical ones (see Figure 2). In addition, these risks are not being reported in a clear and comparable format across financial institutions (FIs).

Figure 2: Physical and transition climate risks

Source: Chartis Research

While the TCFD framework offers several suggestions for metrics for transition risks, it does not include metrics for physical climate risks. So that FIs can provide more useful information to investors, there is a clear need for standardized and clearly reported assessment methodologies and risk metrics for physical risks, based on the TCFD framework.

Location considerations

FIs have other issues to contend with. In order to consider the sensitivity of assets to climate-related hazards, credit analysts need to know the specific location and features of the assets underlying their lending portfolios. And to translate climate risk exposure into financial impacts, analysts face significant challenges around projection timeframes and the quantity, granularity and format of the data being used. While carbon regulations impact entire geographies, an asset’s exposure to extreme rainfall or rising sea levels depends on its specific geographic location. Different regions have different elevations, topography and sensitivities, so will be affected differently by climate change. The same extreme event, for example, can have varying effects on economies and assets in different locations.

A way forward

There are several ways that FIs can address these issues. Climate stress tests could improve data harmonization, as the need to complete these tests will prompt banks to gather climate data in a more standardized way. Risk assessments should leverage adaptable, forward-looking, science-driven data, capturing the relative climate change for each location, and incorporating multiple datasets to capture different dimensions of risk across hazards. The results can then be integrated into existing process and business applications.

Furthermore, to capture climate risk accurately, firms must assess it over long horizons and with new methodological approaches. Given the file format and raw size of climate data, assessing climate-change risks over many facilities with multiple financial metrics requires significant computing power and a specialized workflow. To improve physical risk disclosures and management, therefore, banks must increase their engagement with climate-risk modelers and data providers.

Key steps to effective frameworks

In general, building climate-related stress tests is a complex process, and FIs should approach it in steps. These include managing physical and transaction risk data, mapping structures, managing impacts and incidents, and reporting.

The depth and complexity of this process means that it is unlikely to be handled from beginning to end by a single entity. FIs will have to establish which parts of the process they will outsource to specific firms, such as data-gathering companies, analytics specialists or business process outsourcing firms. As the market develops and matures, more parts of this process will be addressed by specific firms that handle different parts of the process chain. We anticipate that FIs’ data requirements will become more normalized, and that the effects and outcomes of stress tests will be more reliable, as climate-change metrics are folded more effectively into capital outcomes and translated into financial metrics.

Further reading

Model Validation Solutions, 2019: Overview and Market Landscape

(Chartis, 2019)

Enterprise GRC Solutions, 2019: Market Update and Vendor Landscape

(Chartis, 2019)

(Chartis, 2020)

Points of View are short articles in which members of the Chartis team express their opinions on relevant topics in the risk technology marketplace. Chartis is a trading name of Infopro Digital Services Limited, whose branded publications consist of the opinions of its research analysts and should not be construed as advice.

If you have any comments or queries on Chartis Points of View, you can email the individual author, or email Chartis at info@chartis-research.com.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@chartis-research.com to find out more.

You are currently unable to copy this content. Please contact info@chartis-research.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@chartis-research.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@chartis-research.com